Does being on the bleeding edge of technology matter?

Techno-changes in banking are coming at the industry with breathtaking speed. Just when you think you know what you should invest in to gear up for one trend, it is leapfrogged by another. As soon as you got done optimizing your website for online banking, mobile came along and required another round of investment and adjustment. Will it ever end? No.

My first boss once told me, “The only thing constant is change.” He was so right. And the pace of change seems to be a logarithmic function these days. In this time of wonderful new developments in personal and business interaction made possible by iThis, iThat and iWait-10-minutes-and-it-will-change-again, how can you keep pace?

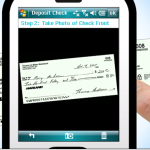

Well, you don’t need to keep ahead of the pack, but you do have to keep up with your customer base — and be ready to offer them what they want, when and how they want it. Which means that your core and ancillary programs have to be ready to handle the data crunching needed by enhanced customer tools. Even if your base isn’t demanding remote or mobile deposit today, for example, get with your systems supplier/integrator and plan for it, because they’ll want it tomorrow. If you wait until your customers have to ask for it, they will drift away while you are scrambling to get up to speed. As the Boy Scouts say, “Be prepared.”