So, what to do when there is a convergence of products, pricing and promotional approaches in an industry that’s overpopulated with players — how do you stand apart?

In this country we are blessed with the opportunities of the free enterprise system that can richly reward the hard work and singular focus of driven entrepreneurs. However, the free enterprise economic model can be a fickle lover. It is devoid of emotion and will turn on the unwary. Today’s success is tomorrow’s Rubicon for those adverse to change and adaption.

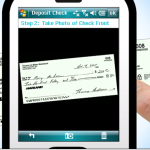

Take banking for example. There are more than 9,000 banks in this country, and with very few exceptions they are all exactly the same. Oh sure, B of A, JP Morgan, Wells, Citi and a few others have the lion’s share of branches and ATMs out there, but they are really no different than each other or smaller banks at their core. They have the same products — basically loans and deposit accounts; they are priced the same — the overnight Federal Funds borrowing rate is virtually the same for all of them, and none can charge more interest on their loans or pay more interest on their deposits for very long before competition eats their lunch. So how do you survive? How about convenience — a branch network in a lot of great locations! Nope, not any more — better and better mobile platforms and apps as well as remote capture/deposit and automated tellers have a lot of branch managers dusting off their resumes. And it’s getting easier and easier for customer-facing folks at banks to remember your name and birthday, because branch traffic in the U.S. is plummeting.Read full post...